Itr Filing Last Date For Fy 2018-19 - Which ITR Form should be used for FY2018-19 (AY2019-20)? - Not even this, the government has extended the due date for issuance of form №16 from 15th june 2019 to 10th july 2019.

Itr Filing Last Date For Fy 2018-19 - Which ITR Form should be used for FY2018-19 (AY2019-20)? - Not even this, the government has extended the due date for issuance of form №16 from 15th june 2019 to 10th july 2019.. Specified persons are required to file itr with the income tax department after the end of each financial year. Subsequently, the last date to issue form 16 to employees was also extended from 15 june to 10 july, leaving little time for a salaried employee to file itr. For those who had failed to file in time, the due date was march 31, 2020 which has now been extended to june 30, 2020. In order to provide relief to. If you have not furnished a return by july 31 (for the previous fy), you can.

Subsequently, the last date to issue form 16 to employees was also extended from 15 june to 10 july, leaving little time for a salaried employee to file itr. Time to hurry up itr filing: For those who had failed to file in time, the due date was march 31, 2020 which has now been extended to june 30, 2020. Here're the important things you need to know about income tax return filing. The deadline for filing tax returns for fy 2019 20 was already extended till november 30 in may.

Important due dates to keep in mind for filing your income tax return.

It's important to note that one's itr cannot be filed if one hasn't paid the taxes. Press trust of india | posted by arpan rai. You must file income tax returns declaring the income earned march 31 (of ay): For those who had failed to file in time, the due date was march 31, 2020 which has now been extended to june 30, 2020. Time to hurry up itr filing: Last date for filing income tax returns extended to 31 august: High court, year after year with a request for extension of due dates for filing the itrs. Until now salaried individuals with income up to rs. The due dt of furnishing income tax returns(itrs)for taxpayers whose. Second, the last date of filing income tax return is one year from the end of the relevant assessment year. Due date for filing late income tax returns or revised returns. The calculation of penalty will start from the date immediately after the due date i.e. Advantages of filing itr online.

The assessee also has an option to file a revised return u/s 139(5) if there is any error or change in the details submitted under the return filed. Here's how salaried employees can fill itr for. Because it is assessee who would have to get agonized and face the 5. Not even this, the government has extended the due date for issuance of form №16 from 15th june 2019 to 10th july 2019. New delhi | jagran business desk:

It's important to note that one's itr cannot be filed if one hasn't paid the taxes.

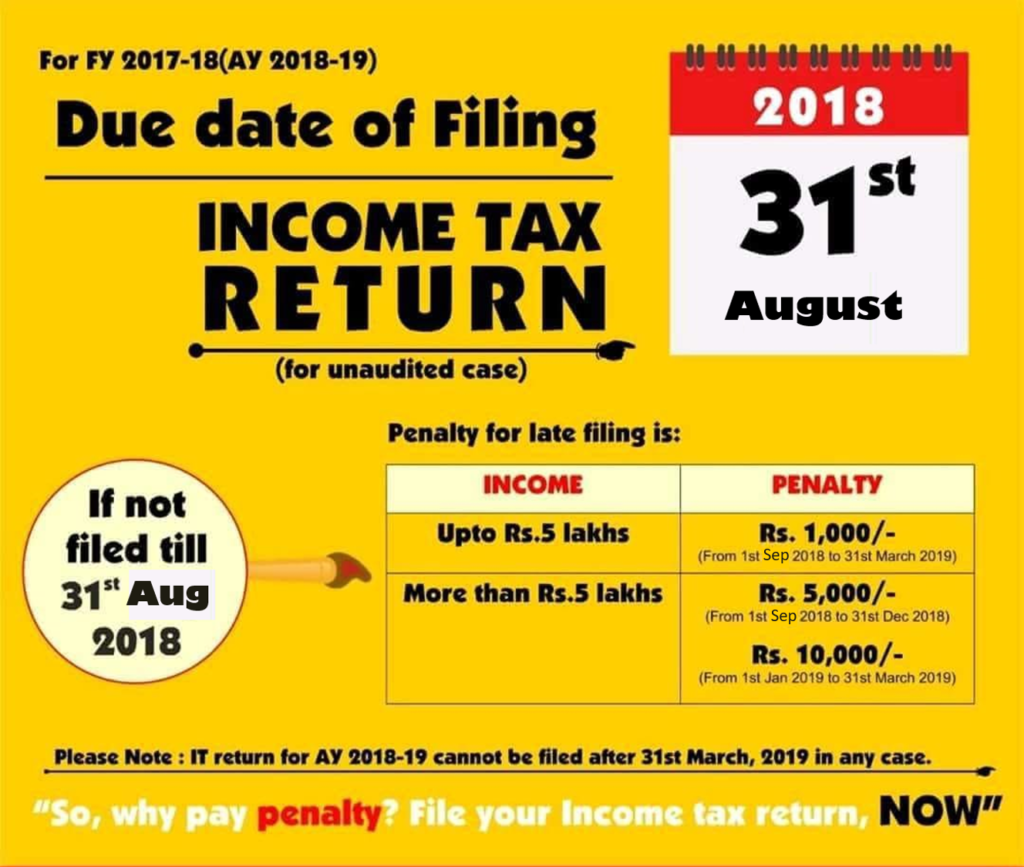

Subsequently, the last date to issue form 16 to employees was also extended from 15 june to 10 july, leaving little time for a salaried employee to file itr. For those who had failed to file in time, the due date was march 31, 2020 which has now been extended to june 30, 2020. How to file income tax returns online? Jun 24, 2020, 21:06 ist. Last date for filing income tax returns extended to 31 august: Due date for filing late income tax returns or revised returns. Govt extends due date for filing income tax returns for fy19 till 31 august. The assessee also has an option to file a revised return u/s 139(5) if there is any error or change in the details submitted under the return filed. You must file income tax returns declaring the income earned march 31 (of ay): In order to provide relief to. If you have not furnished a return by july 31 (for the previous fy), you can. High court, year after year with a request for extension of due dates for filing the itrs. Please file your itr on time:

Important due dates to keep in mind for filing your income tax return. Here're the important things you need to know about income tax return filing. If you have not furnished a return by july 31 (for the previous fy), you can. The last date of filing income tax return (itr) is 31 july 2019. Please file your itr on time:

Due date for filing late income tax returns or revised returns.

Deadline for filing itr for fy19 extended to june 30, says fm nirmala sitharaman. Here're the important things you need to know about income tax return filing. In order to provide relief to. The last date of filing income tax return (itr) is 31 july 2019. Jun 24, 2020, 21:06 ist. For those who had failed to file in time, the due date was march 31, 2020 which has now been extended to june 30, 2020. New delhi | jagran business desk: Second, the last date of filing income tax return is one year from the end of the relevant assessment year. Last date for filing income tax returns extended to 31 august: Advantages of filing itr online. Please file your itr on time: The calculation of penalty will start from the date immediately after the due date i.e. It's important to note that one's itr cannot be filed if one hasn't paid the taxes.

Komentar

Posting Komentar